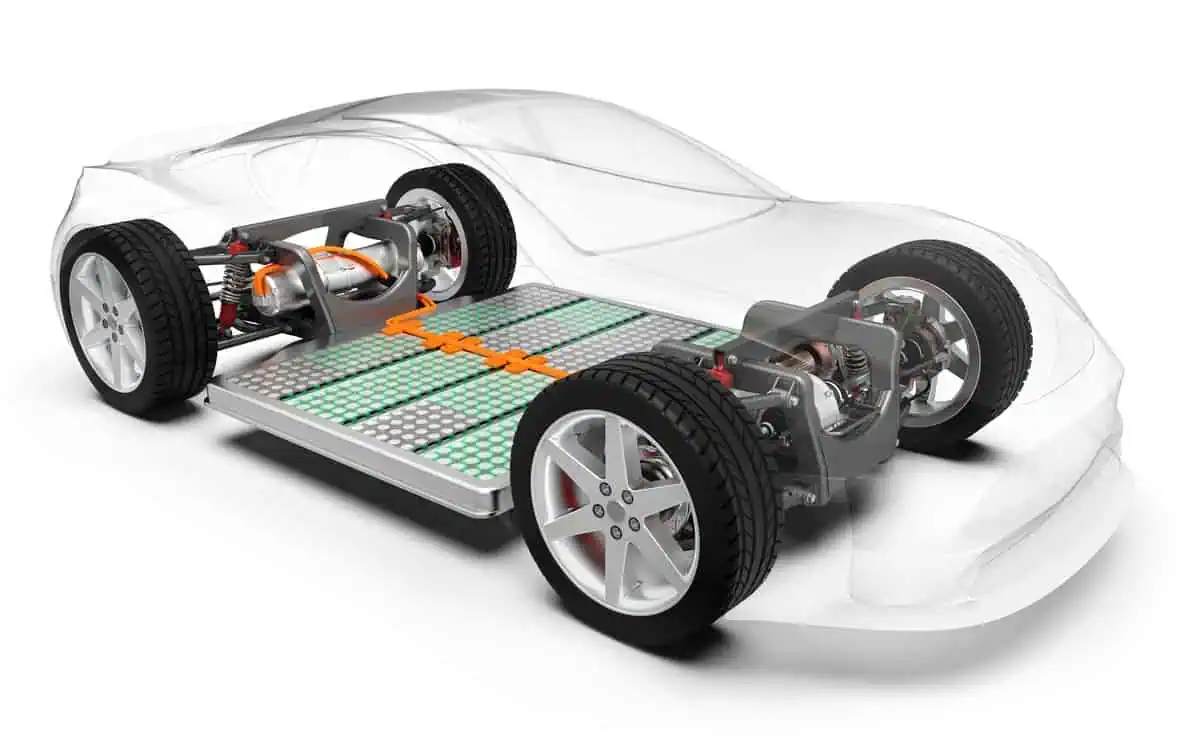

The global automotive industry has pledged $1.2 trillion to develop electric vehicles, creating a golden opportunity for new suppliers to win contracts covering everything from battery packs to motors and inverters.

Businesses specializing in batteries and protective coatings for EV parts, as well as manufacturers traditionally focused on niche motorsports or Formula One (F1) racing, are competing for EV contracts. Carmakers build systems to last a decade, allowing high-volume models to generate significant revenue for years.

Next generation of EVs in 2025

The next era of EVs is expected to arrive around 2025, and many automakers have sought assistance in filling gaps in their expertise, creating a window of opportunity for fresh suppliers.

We’ve gone back to the days of Henry Ford where everyone is asking, ‘how do you make these things work properly?,

that’s a huge opportunity for companies like us

Nick Fry, CEO of F1 engineering and technology firm McLaren Applied stated on EV evolution

“That’s a huge opportunity for companies like us.”

McLaren Applied, purchased from McLaren by private equity firm Greybull Capital in 2021, has developed an efficient inverter for F1 racing for EVs. An inverter regulates the flow of power to and from the battery pack.

The 5.5 kg (12 lb) silicon carbide IPG5 inverter can increase an EV’s range by more than 7%. McLaren Applied, according to Fry, is collaborating with around 20 automakers and suppliers, and the inverter will be available in high-volume luxury EV models beginning in January 2025.

Traditional manufacturers committed to EV investments

Mass-market automakers frequently prefer to build EV components in-house and own the technology. They are wary of over-reliance on suppliers after years of pandemic-related parts shortages.

We just can’t afford to be reliant on third parties making those investments for us

Tim Slatter, head of Ford in Britain stated on the production of own EV parts

Traditional manufacturers, such as German heavyweights Bosch and Continental (CONG.DE), are also committed to investing in EVs and other technologies to remain competitive in a rapidly changing industry.

Smaller companies, however, say there are still opportunities, especially for low-volume manufacturers who need help to afford significant EV investments or luxury and high-performance automakers looking for a competitive advantage.

Rimac, a Croatian electric hypercar manufacturer part-owned by Germany’s Porsche AG that also provides battery systems and powertrain parts to other automakers, says an unnamed German automaker will utilize a Rimac battery system in a high-performance model with a yearly production of around 40,000 units beginning this year, with more lined up.

We need to be 20%, 30% better than what they can do, and then they work with us, If they can make a 100-kilowatt hour battery pack, we must make a 130-kilowatt pack in the same dimensions for the same cost

Mate Rimac, CEO of Rimac stated on developing more advance batteries

Suppliers collaborating with several new OEMs

Several suppliers, such as Cambridge, Massachusetts-based Actnano, have long worked with EV pioneer Tesla (TSLA.O). Actnano has created a coating that protects EV parts from condensation. Its business has expanded to advanced driver-assistance systems (ADAS), Volvo (VOLCARb. ST), Ford, BMW, and Porsche.

CelLink, a California-based startup, has created an entirely automated, flat, and simple-to-install “flex harness” instead of a wire harness to a group and direct cables in a vehicle. CelLink CEO Kevin Coakley declined to identify customers but stated that CelLink’s harnesses had been installed in approximately a million EVs. Only Tesla has that kind of reach.

Coakley stated that CelLink was collaborating with carmakers in the United States and Europe and a European battery manufacturer on battery wiring.

Others focus on low-volume manufacturers, such as the UK startup Ionetic, which creates battery packs that are too costly for smaller businesses to produce.

Currently, it costs just too much to electrify, which is why you see some manufacturers delaying their electrification launch,

James Eaton stated on electrification cost

Adapting to the EV industry evolution

Swindon Powertrain has been constructing powerful motorsports engines since 1971. However, it has now developed battery packs, electric powertrains, and e-axles and operates with around 20 customers, including automakers and an eVTOL aircraft manufacturer.

I realized if we don’t embrace this, we’re going to end up working for museums

Raphael Caille stated on EV industry adaptation

According to Mate Rimac, significant automakers have struggled to roll out EVs over the past three years and have developed mainly strategies.

For those who haven’t signed projects, I’m not sure how long the window of opportunity will remain open

Mate Rimac, CEO of Rimac stated on EV opportunities