A lithium mining start-up will create a U.S-listed company in a blank-cheque merger as a severe metal shortage has become the most critical supply chain holdup in electric vehicles rollout, according to Financial Times.

European Lithium & Sizzle Acquisition Merging

European Lithium, claiming to own the region’s first fully-licensed lithium mine and has deposits in Austra, will merge with Sizzle Acquisition, a special acquisition company, to build Critical Metal.

In addition, Europen Lithium has already been listed in Australia and will continuously trade in the country and will also be the biggest shareholder in Critical Metals. It will have a market capitalization of $972 million.

Notably, other companies have encountered challenges in acquiring a permit to mind the metal in Europe, partly due to environmental concerns.

Europe’s lithium supply development complications have made it hugely dependent on China. It could cause issues for the region’s automakers as they rapidly try to secure local battery materials. China controls about 60% of global lithium processing.

The deal comes in light of a terrible metal shortage, with prices closing to record highs of $70,000 per ton, eight times their level at the start of last year.

Furthermore, this follows electric vehicle sales in China ahead this year, with the supply of metal having difficulties keeping up to speed.

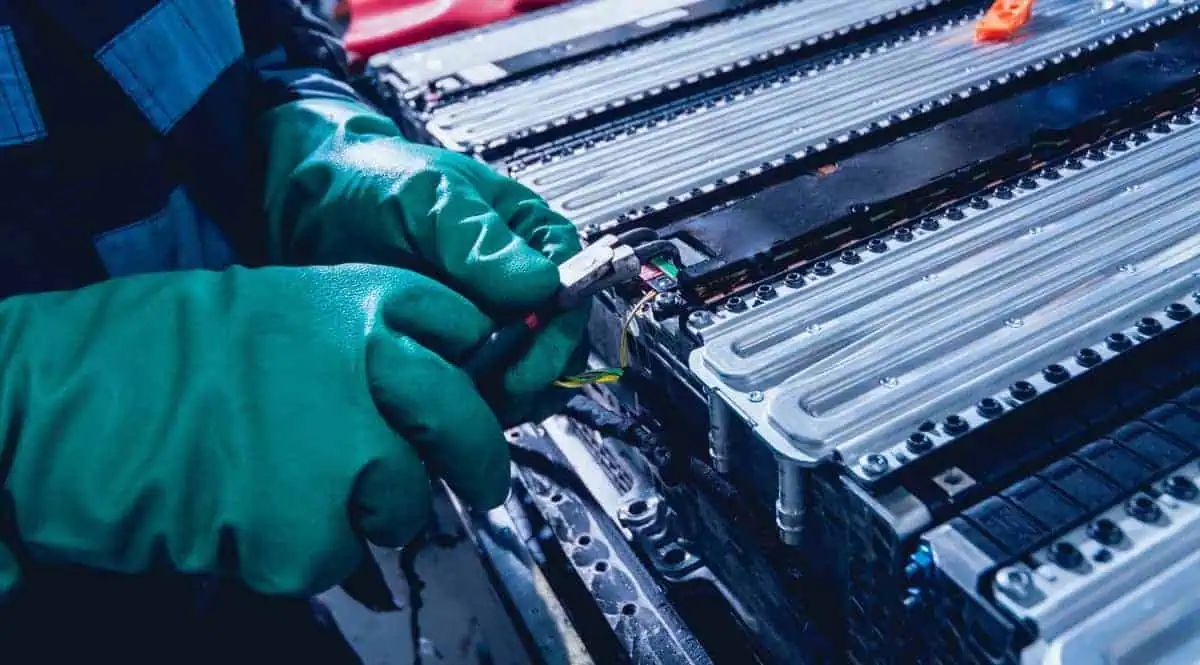

Lithium Mining in Europe

Issues over getting permits have pulled back lithium mining in Europe.

For instance, Rio Tinto’s exploration licenses for its project in Serbia got revoked, whereas Savannah Resources has yet to receive environmental approval for the development of lithium from Portugal authorities.

“The need for additional battery-grade lithium in Europe will only continue to accelerate as demand for EVs continue to outstrip supply,” stated Tony Sage, Critical Metals’ executive chair.

The Wolfsberg site, located about 270 km south of Vienna, is expected to produce around 10,500 tons of lithium concentrate per year beginning in 2025, sufficient for 200,000 electric vehicles.

The concentrate has to be refined into chemicals usable in EV batteries.

The high prices of lithium have been prompting a flurry of activity in raising capital for mine development. On Monday, the mining solutions group, Imerys, stated it was launching a lithium project in France that hopes to manufacture 34,000 tons of lithium hydroxide per year starting in 2008.

European Lithium has a memorandum of understanding with BMW, a German automaker, to pre-pay $15 million for lithium in the future,

Others, such as General Motors, Ford, and Stellantis, have done the step of pre-financing mines and obtaining equity stakes in early-stage mining groups.

Lithium is a critical element of EV batteries because it’s lightweight, with demand expected to multiply a few times in the next decade.