The expected surge in lithium carbonate supply in the US will drive down electric vehicle battery prices. According to the International Council On Clean Transportation’s new research, this phenomenon will enable battery-powered cars to compete with those of internal combustion engine-powered vehicles by 2029.

Status quo

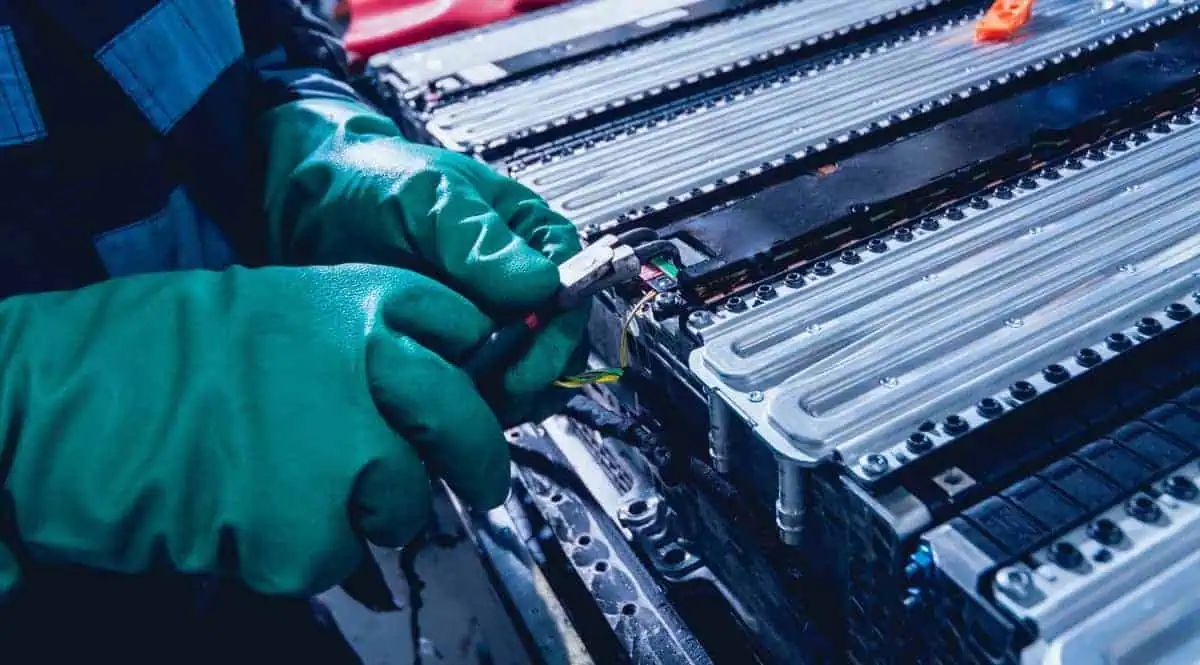

Electric vehicle batteries remain expensive, accounting for about 40% of the vehicle’s overall cost. It is unsurprising, considering that these batteries use hard-to-acquire minerals like lithium, nickel, manganese, graphite, etc.

Lithium demand has surged amid the global shift to EVs in the past few years, significantly increasing its price. As of today, Australia’s open-pit mines and South America’s evaporation ponds mostly support the global lithium demand. However, the US’ imminent growth in lithium extraction and refining can potentially reverse that.

Potential surge of supply

According to ICCT’s “Investigating the US Battery Supply Chain and Its Impact on Electric Vehicle Costs Through 2032” report, the US now has more than 100 lithium mining and refining projects on the pipeline, including those from the countries it has “existing and potential” trade agreements.

ICCT also forecasts the US lithium carbonate demand to hit around 340 kilotons per annum (ktpa) by 2032 for light-duty electric vehicles alone. However, the US and its trading partners are expected to produce several times more lithium carbonate than that.

Their lithium extraction and refining capacities are projected to reach 1,310 ktpa and 1,030 ktpa, respectively, by 2025. These capacities are further expected to rise to more than 2,000 ktpa by 2032.

Direct impact

All that said, the US will undoubtedly have way more lithium carbonate supply compared to the demand. In effect, it would significantly lower the prices of batteries, which would also reduce the overall cost of electric vehicles in the country.

As per the estimate, pack-level costs will drop from $122/kWh in 2023 to around $91/kWh in 2027. It will further decline to $67/kWh in 2032.

In that sense, ICCT suggests that an average new electric vehicle with a driving range of 300 would match the pricing of its gas-powered counterpart by 2028 to 2029.