Electric vehicle adoption is continuously progressing in the world’s largest auto industry. EV-Volumes data shared by Jose Pontes revealed that plug-in vehicle sales topped 600,000 units in China in May 2023, representing a year-on-year increase of 54%. That remarkable result also raised the year-to-date figure to more than 2.5 million sales.

In effect, plug-in vehicles accounted for a whopping 35% of the overall market. Of that total, battery-electric vehicles contributed 24%.

The industry expert cites this significant growth rate as an indication of plug-in vehicles’ potential to hit more than 40% share in the Chinese market by the end of this year.

It is also worth noting that China alone accounted for approximately 60% of plug-in vehicle registrations globally in May.

Major players’ market share: Tesla sees decline due to growing competition

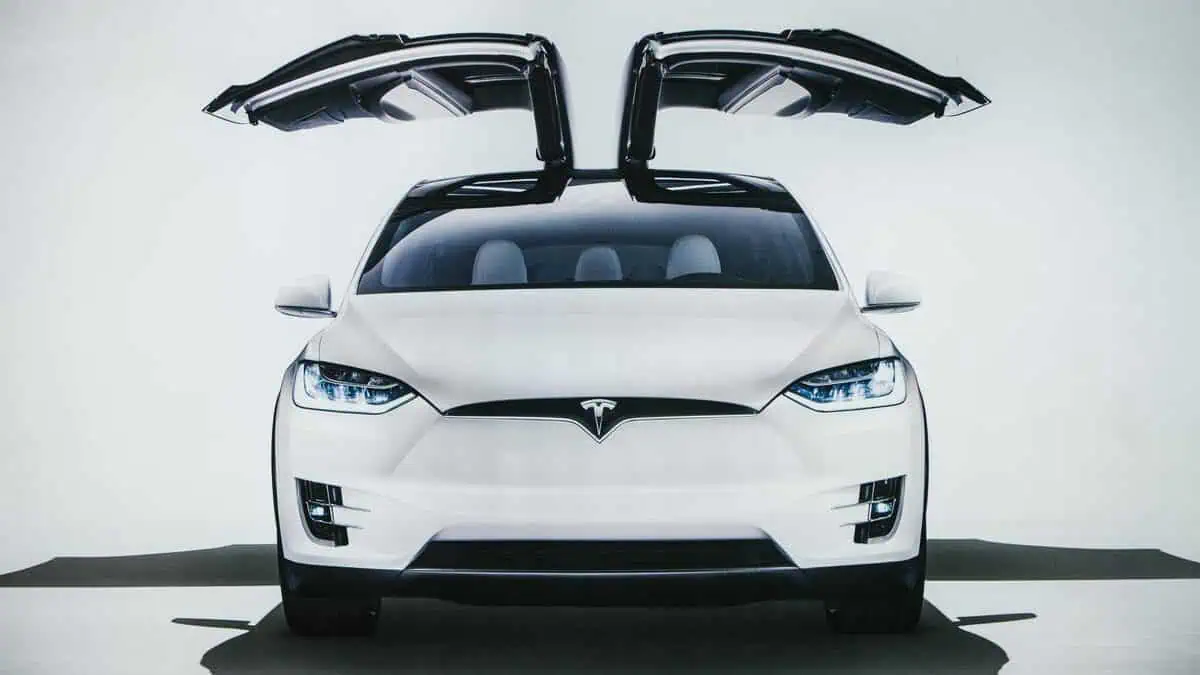

Leading American electric automaker Tesla continues to gain traction in the Chinese EV market, accounting for the second largest market share of 8.7%. However, this figure indicates a notable decline from its April record of 9.3%.

It must be noted that the decline is only natural considering the number of local brands’ continuous introduction of more EV models.

Despite the decline in market share, the industry still expects Tesla to report record sales figures in China. The Musk-led automaker advanced as a major player in the Chinese EV market, particularly driven by its production ramp-up at the Giga Shanghai. The EV volumes continue to increase, allowing Tesla to record new sales high in China.

China Merchants Bank International Securities analyst Shi Ji claimed that Tesla will hit 155,000 unit deliveries in Q2 2023, up 13% from the prior record quarter.

On the other hand, the largest market share winner was BYD, dominating the ranking with a remarkable market share of 36.0% in May.

GAC Aion secured the third spot with a market share of 6.6% (up 0.3%), followed by SGMW with 6.0% (up 0.1%).

The top five were completed by Li Auto with a market share of 4.2%, indicating a minor growth from its 4.1% share in April.

Below are the top brands in the Chinese market:

| Rank | Brand | Share |

| 1 | BYD | 36% |

| 2 | Tesla | 8.7% |

| 3 | GAC Aion | 6.6% |

| 4 | SGMW | 6.0% |

| 5 | Li Auto | 4.2% |

Top 20 best-selling EVs in China in May 2023

| Rank | Model | May | % |

| 1 | BYD Qin Plus (BEV+PHEV) | 42,887 | 7.0% |

| 2 | BYD Song (BEV+PHEV) | 37,610 | 6.1% |

| 3 | Tesla Model Y | 31,054 | 5.1% |

| 4 | BYD Dolphin | 30,441 | 5.0% |

| 5 | BYD Yuan Plus | 26,072 | 4.2% |

| 6 | GAC Aion S | 25,233 | 4.1% |

| 7 | Wuling HongGuang Mini EV | 20,346 | 3.3% |

| 8 | BYD Han (BEV+PHEV) | 20,158 | 3.3% |

| 9 | GAC Aion Y | 19,306 | 3.1% |

| 10 | BYD Seagull | 14,300 | 2.3% |

| 11 | Wuling Bingo | 14,164 | 2.3% |

| 12 | BYD Tang (BEV+PHEV) | 11,871 | 1.9% |

| 13 | Tesla Model 3 | 11,454 | 1.9% |

| 14 | Li Xiang L7 | 11,119 | 1.8% |

| 15 | Denza D9 (BEV+PHEV) | 11,005 | 1.8% |

| 16 | BYD Frigate 07 PHEV | 10,005 | 1.6% |

| 17 | BYD Destroyer 05 PHEV | 9,840 | 1.6% |

| 18 | Changan Lumin | 8,491 | 1.4% |

| 19 | BYD Seal | 8,062 | 1.3% |

| 20 | Changan SL03 (BEV+PHEV) | 8,021 | 1.3% |

| Others | 242,922 | 39.5% | |

| TOTAL | 614,361 | 100% |

BYD Qin Plus (BEV+PHEV) led the pack with 42,887 registrations in May, with the BEV variant alone accounting for 10,816 units. BYD Song (BEV+PHEV) followed it with 37,610 registrations.

Tesla’s famous Model Y landed in the third spot with 31,054 registrations, followed by more BYD models: Dolphin (30,441) and Yuan Plus (26,072).

How can Tesla maintain its advantaged position in the Chinese market?

Shanghai-based consultancy Automotive Foresight Managing Director Yale Zhang stated that Tesla must reach China’s smaller cities to maintain its growth. However, he worries that erecting service centers and stores could impede the automaker from actually pursuing this expansion.

“Tesla has to sell into China’s lower tiered cities to seek further growth, but its direct sales model would be too costly to expand its sales network into hundreds of such cities.”

Yale Zhang, Automotive Foresight Managing Director

Zhang further noted that BYD’s dominant position in the domestic market is significantly due to its dealership business.

See Also:

- Dual carbon goal supports growing energy storage sector in China

- Tesla China reports impressive insurance registrations, poised for strong June sales

- China’s dominance in the global EV industry starts to weaken

- China’s new EV subsidies may be insufficient to brace market slowdown

- China to dethrone Japan as the World’s biggest car exporter thanks to growing EV adoption

China has once again demonstrated stronger electric vehicle adoption than other economies. The domestic market continues to report record-breaking EV registrations, primarily due to the major automakers’ presence in the industry.

Tesla continues to maintain its competitiveness in the Chinese market. The previous market share decline does not significantly affect its success. However, it only proves that the market is starting to see more EV models from other brands.