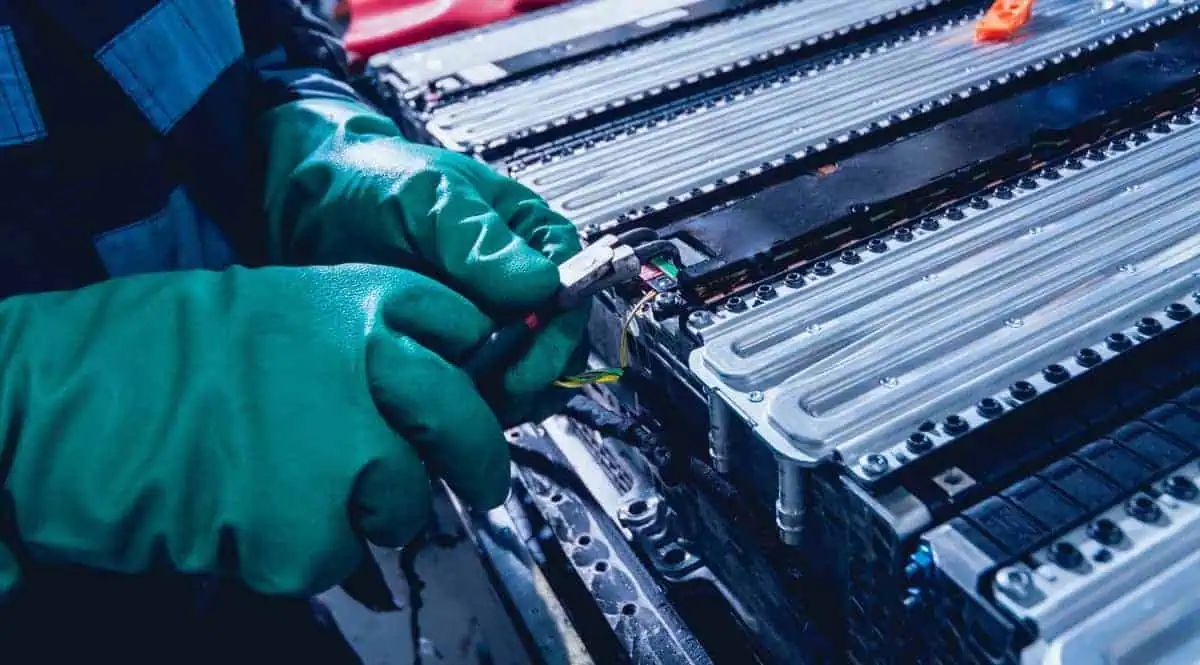

Chinese electric vehicle battery firms are indeed leading the global industry

In 2022, Chinese power battery giant CATL held 37.0% of the global market of Chinese firms, per SNE Research. Meanwhile, EV giant BYD had a 13.6% market share. Therefore, these two alone already accounted for more than half of the global market share at 50.6%.

It is also worth noting that last year’s five of the top 10 EV battery firms globally are from China, including CALB, Gotion High-tech, and Sunwoda.

Top 10 EV battery makers in 2022

| Manufacturer | 2022 growth | 2022 market share |

| CATL | 92.5% | 37.0% |

| LG Energy Solution | 18.5% | 13.6% |

| BYD | 167.1% | 13.6% |

| Panasonic | 4.6% | 7.3% |

| SK On | 61.1% | 5.4% |

| Samsung SDI | 68.5% | 4.7% |

| CALB | 151.6% | 3.9% |

| Gotion High-tech | 112.2% | 2.7% |

| Sunwoda | 253.2% | 1.8% |

| Farasis Energy | 215.1% | 1.4% |

| Others | 55.9% | 8.6% |

| Total | 71.8% | 100% |

Ten Chinese firms raised $3.4 billion in Switzerland’s principal stock exchange

International media platform CGTN reported that China’s tech firm Zhejiang Hangke had accumulated a whopping $173 million by releasing global depositary recipes (GDRs). Notably, it marks the first listing for this year under the existing China-Switzerland stock net program since its commencement in July 2022.

“We raised $173 million by issuing global depositary recipes. The money is used solely for developing overseas markets, housing manufacturing capabilities and optimizing after sales services.”

Liu Wei of Zhejiang Hangke

In essence, it enables firms that trade on exchanges in either nation to seek secondary listings by issuing GDRs.

“So far we have ten Chinese companies that listed our GDRs on our exchange, raising about $3.4 billion.”

Juerg Schneider, Director of Switzerland’s principal stock exchange SIX

The report noted that the Swiss exchange’s competitors in NY and London have long fallen behind SIX with $3.2 billion raised capital. It indicates a major advancement compared to the 2022 record of Wall Street’s NYSE of 470 million.

Hangke apparently opted for Switzerland owing to its streamlined process for listing stocks. However, the current China-US political disputes are another interesting factor that influenced the Chinese tech firm to pursue Swiss exchange.

“When there is tension rising between these three economies, then many of the Chinese businesses will start to seek different markets, especially those markets that are not directly following the foreign policy of the US.”

Chen Jiahe, Novem Arcae Technologies’ Chief Investment Officer

See Also:

· BYD plans to build another $1.2 billion EV battery plant in China, per filings

· Ford and a Chinese partner plan to construct an EV battery plant in Michigan

· EV battery market grew 71.8% in 2022, CATL remained unbeatable

· Global EV battery market share in November

· Price parity further away as EV battery costs increase

Interestingly, CGTN claims that another 20 Chinese firms are looking to issue GDRs this year. It projects that more companies from China may issue GDRs once the China-Switzerland stock net program reaches Germany.