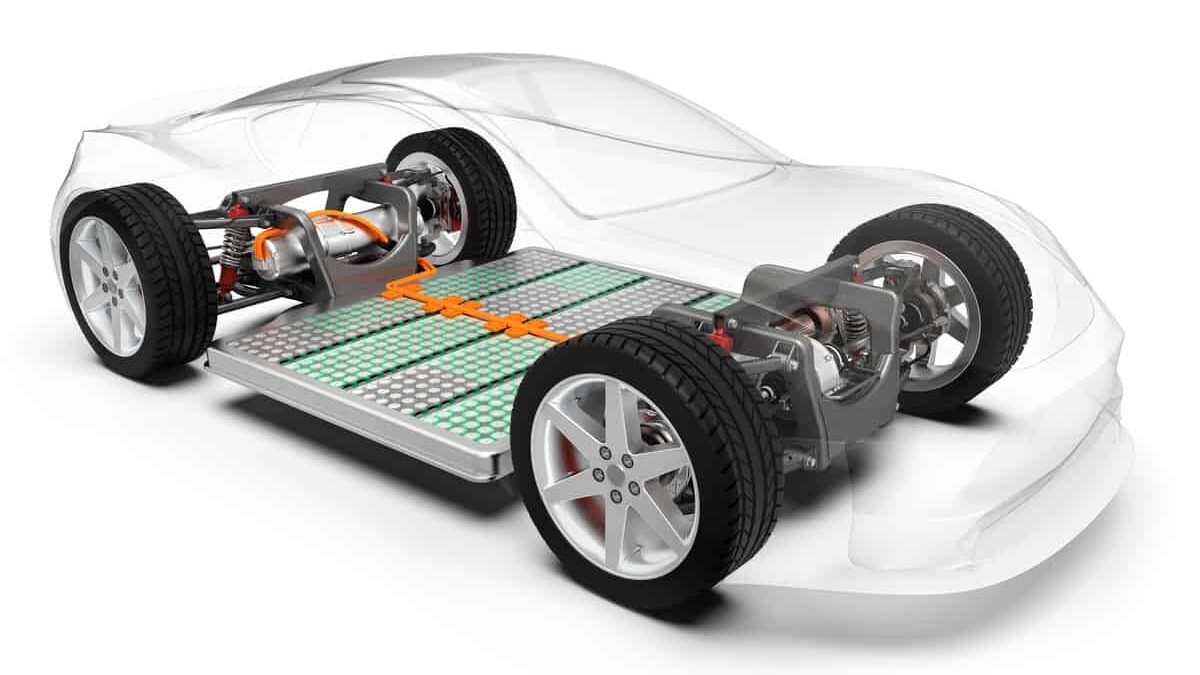

Measurement and management of battery cell performance is going to become increasingly critical as the electric vehicle industry progresses.

Charged reported that Dr. Michael Baumann and Dr. Stephan Rohr formed the German company TWAICE in June 2018 to meet the urgent demands in the EV ecosystem. Remarkably, TWAICE has amassed a substantial database of information about how various cells from various manufacturers age and operate over time.

In addition, it has created a platform that assesses the health of current battery packs and can mimic the performance of various cells in real-world settings. In order to create a test and certification system for used elecric vehicle batteries, TWAICE has collaborated with TÜV Rheinland.

For reference, TÜV Rheinland is a network of firms in Germany and Austria known as the Technological Inspection Association that tests, inspects, and certifies technical systems.

Co-founder Michael Baumann discussed the various uses for his company’s battery analytics technology with Charged.

Charged: Tell us about the origins of the company.

| Michael Baumann: I’ve always been a very technology-passionate and technology-driven person, and I wanted to make an impact with technology for the planet and for our society. This is why I studied mechatronics, and finished my studies with battery management systems for electric vehicles. And this was also the motivation for doing a PhD in that space to dig a few steps deeper. This was where I met Stephan Rohr, my co-founder—we met at the beginning of our PhDs in 2014, when we investigated second-life batteries.Stephan did a techno-economic analysis of that—all the different economical aspects, when the second life makes sense, how much revenue can you generate, and so on. And I specifically concentrated on the technological challenges which come along with batteries, but which are especially important for second life.What’s the key challenge with batteries? Batteries age over time, but the question is, what influences the life of a battery? How can you get insights about the life and the performance of batteries? Back then, there was no way to do this—there were a lot of uncertainties when it came to batteries, which is a bad thing when you have uncertainties on a very costly component. This was the motivation for my PhD thesis, and then later on, also for TWAICE. We said, ideally, you have this digital twin of a vehicle battery, which is like a model of the physical battery system. This is connected with all the individual batteries in the field, and gets all the data on the vehicles or stationary storage or whatever. And then you are able to tell [from] the digital twin, how each individual battery in the field performs, like how it ages over time and also how we can influence this behavior. Early on, the idea [was to address] the field of second-life vehicle batteries, but Stephan and I soon realized that you actually can apply it to the whole life cycle of batteries. That’s what TWAICE is doing—battery analytics, all along the life cycle and for different industries. There are a lot of reasons why it makes sense to [study] the whole life cycle, because you can then really generate the value in these individual steps. So, starting from the development phase where you help to speed up the development process, [you can] save time, save costs, get a faster time to market. And then it stretches to end of life—potentially second life, quantifying residual value and so on. Back in our PhD [days] we saw the potential of this technology, and no one else was doing this. Nowadays, there are other startups popping up in this field, which is also good, because it’s a lot of market education in this new market. But back then, we really saw the potential of this and decided to spin this off after our PhD, which we did in 2018. |

Charged: What exactly is the product?

| Michael Baumann: The product in the end is a battery analytics software platform, which we are building out—it addresses the whole life cycle of batteries, and can be used by different industries. This platform has different solutions, and these solutions can be very specific. To give you some examples, we have a development tool, which is at the moment used by automotive OEMs—all the big German ones for example. It’s a simulation tool, which can virtually test and model individual cells, but also complete battery systems.It models the electric, the thermal and the aging behavior, and it is used by battery engineers to design the battery pack and then simulate, see if it stays within certain temperature boundaries, how long it will actually last in the field. Is it oversized? Is it undersized? What about the thermal cooling system, and so on? So, it addresses these questions, but then when we take a look into in-life, there we have different solutions depending on whether you are an automotive OEM and want to monitor your vehicles in the field, whether you are a fleet operator and you want to determine the best charging infrastructure for your bus fleet, or if you’re a stationary energy storage operator and you need to determine which kind of operating strategy you should run on your storage. So, these can be very different solutions for our customers, but they are all built on top of the same battery analytics platform, which uses the same technology, algorithms and models. |

Charged: Taking a step back, how do you get the core data?

| Michael Baumann: That’s a very good question. There are essentially two ways and also two types of data we distinguish. One is lab data. I mentioned this development tool [with which] you can simulate batteries. In the development process, you typically don’t have field data yet, because you are developing the system, there are no vehicles in the field yet. We parametrize these simulation tools with in-house measurements in our own battery laboratory on cells and/or modules.We have a laboratory in Munich, which we are also extending right now. Typically, customers send us some sample cells, and then we do measurements—electric and thermal measurements, aging measurements—and then we parametrize our software and ship them the software back, which they then use in their applications. So that’s one step. The other data source is of course field data. Once vehicles and systems get into the field, we then get the data from these vehicles. There are different ways how we can get them. It’s directly sent to us, to our platform, [from] telematic units on [the vehicles], or our customers can also input data batches into our platform via API. And then we do our analytics on this field data and then give back insights like the state of health of the battery in the field. Are there any anomalies, failures, or whatever? And of course, also a prediction, how long will the battery last under these circumstances? |

Charged: What was the most popular application that people started using this data for? And what do you think in the future would be next-generation stuff for your platform?

| Michael Baumann:In our first customer calls, we really first had to explain the problem to our customers, and why they need battery analytics software to solve it. This has improved now quite a lot, but the market is still very, very young, I would say. We always talk about the battery super-cycle in this context. What we mean is that the combustion engine has now had a century of optimization and development. With batteries, we are probably at the starting point of this century, perhaps it’s just decades, but it definitely will take some time. And we are now developing the tool to optimize these batteries to maintain them, to monitor them, and so on. But this also means we have to develop ourself with the market. What we see now is that a lot of our customers have their biggest pains in the development of the systems. When you take a look at automotive OEMs (but I think it’s even worse in other industries like buses, or trucks), they are really now developing the first generations of electric vehicles. So, there’s really a need for good tools to do a proper design of these systems, like fast testing, also virtual testing, not only doing physical testing in the field or in the lab, to really speed up the development process.This is also why we have a lot of customer engagement with our development tool, our simulation tools, and within the development process, but it’s also moving more and more into in-life, because that’s naturally the next step in the life cycle. And this also has tremendously changed when we take a look at the last one or two years. [In] the energy industry, we now really see a large ramp-up of certain players. That’s also a reason why we set up an office in the US last year. There are already a lot of really mature energy players like Fluence and Eaton, also customers of ours, and now we are starting first projects with them. But they have very aggressive plans for hundreds and thousands of megawatt-hours over the course of the next months and years, so we are slowly but steadily moving more towards in-life. For instance, we formed a joint venture with [testing organization] TÜV here in Germany to develop a solution to quantify the residual value of used car batteries. |

Charged: The energy players you mentioned, you’re talking about stationary storage on the grid?

| Michael Baumann: Yeah—it’s essentially three levels, we always say. There are these really large grid storage [systems], which have hundreds of megawatt-hours, sometimes even gigawatt-hours. Then there’s kind of the middle layer, which is also industrial storage, can be like tens of kilowatt-hours up to megawatt-hours. And then there’s the residential storage market—essentially storage in your cellar with a few kilowatt-hours. And we are now active in all of them. |

Charged: For the smaller bus and truck companies designing their first or second generation of EVs, what decisions are you helping them to make? Are they choosing between different cell suppliers? Is it pack size? What exactly is your tool helping them evaluate?

| Michael Baumann: Multiple questions there—one you already mentioned is supplier benchmarking and selection. A typical use case there is that you want to investigate and simulate different cells in order to find out what’s the best one for your application, in terms of energy density, power, power density, costs, lifetime, safety, and so on. And we have one tool called Model Library in our offering, which does exactly that. It’s a library of cell models—different suppliers, different sizes, cylindrical, pouch, prismatic, different chemistries. And you can get a license for that and then choose different cell types in our online platform. Then you download the model and you can directly simulate the behavior of these cells. And then you can see whether it fits your application or not, and then select the cell and move forward in your design process. Once you’ve selected a cell, then you typically need to design the modules and the system around it, and that means you have to select what voltage level you need. Serial connections of cells, energy content, parallel connections of cells, then what about temperature and climate conditions? Do I need a cooling system or not? And essentially, you can build this in your simulation environment, then simulate the cell module and system behavior, and then see whether it fulfills the requirements in terms of thermal conditions, duty and range conditions, and of course also lifetime.So that’s like a typical development workflow in a nutshell. |

Charged: Can you tell us more about the analysis tool you are developing with TÜV that OEMs or individuals can use to evaluate a used vehicle?

| Michael Baumann: That’s one very, very big problem right now, because when you buy a used EV as an end customer, you are essentially buying a black box with the battery system, and the battery system makes 30% to 50% of the vehicle costs. So, now in this joint venture with TÜV [Technical Inspection Association], we are addressing exactly this. The idea is that we have a product that, when you are selling a car, or when you want to buy a car from someone, you can drive this car to a workshop of the TÜV or other partners, then we connect a charger to it, like an 11-kilowatt charger. We perform a certain charging profile for half an hour or so, then we process the measurements we get from the car, really low-level measurements of voltage, current, temperature and so on, within our platform. Then you will get a certificate which states the residual state of health of the battery. It will also give you a number in terms of dollars or euros, what the battery and also the vehicle is worth. This of course gives a lot of trust and removes the uncertainty in the used electric car market. |

Charged: You recently opened an office in the US. How big is your current team?

| Michael Baumann: Right now, we are around 120 people all in all, and we have three offices. The headquarters are in Munich, we have one office in Chicago for our US business, and we have another one in Paris for the Southern European market. We are a purely venture capital-financed company. This was very important for Stephan and myself to keep TWAICE independent. We didn’t want to bring in some strategic investor to give the company a strategic angle. We really want to build this battery analytics platform as an independent third party in the market, so this is why we decided on venture capital. We have had five rounds so far, and have raised around $75 million US in these five rounds. The second-to-last was led by Energize Ventures. That’s a fund based in Chicago, a very operational and hands-on fund in the energy and electric mobility space. This was kind of a strategic decision for us, why we picked Energize, because they really helped us enter the US market. |

Charged: This seems like a great platform and business opportunity, because everyone from cell manufacturers to used car buyers have a need for this type of battery analysis. Are you working on any other interesting applications that we haven’t discussed?

| Michael Baumann: Battery analytics will be a tremendous market in the next five to ten years, and it will be super-important to really make electrification and renewable energy a success story. We set out to define this market, and to be the key player in this, but we not only want to do this by ourselves and not purely by our product, but also actually to reflect certain partner approaches. I already mentioned the joint venture with TÜV. There are also two other things which go in that direction. One is that we have a collaboration with [German multinational insurance company] Munich Re, with whom we are offering insurance solutions for battery storage for the stationary field, but also in the future, for mobility. And then another exciting example is that we work together with companies like ViriCiti, who got acquired by ChargePoint. They are offering fleet management software for electric bus fleets, and we are giving them the battery insights, which they then also pass to their customers. So that’s one important thing—we are very much working on certain partner approaches to really build out an ecosystem of battery analytics and battery analytic-powered solutions in the future. |