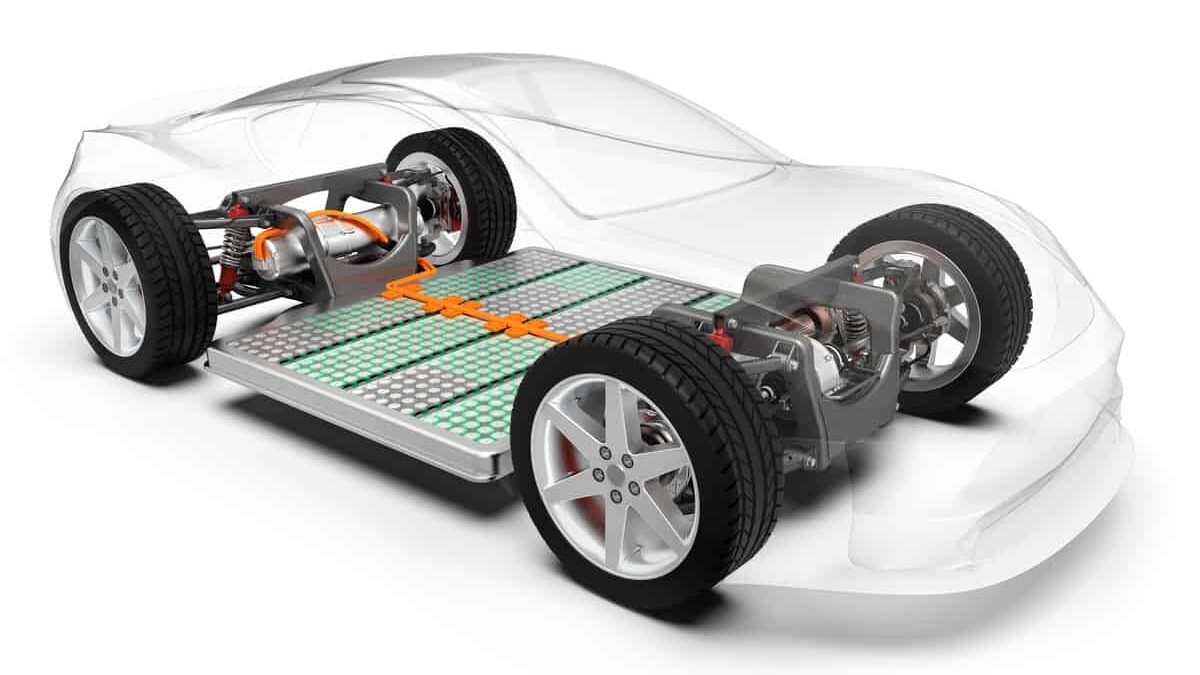

The acquisition will turn Nikola into a battery manufacturer and give it control of critical battery pack engineering and manufacturing process.

Nikola Corporation initiated contract with Romeo Power to get the battery supplier for about $144 million. “Romeo has proven battery pack technologies and a significant battery cell supply agreement in place.” Nikola stated the purchase would enable it to ensure control of critical battery pack engineering and manufacturing process.

The agreement is expected to increase yearly price-earnings of up to $350 million by 2026, thanks to the combined commercial car electrification platform, with Nikola, also expecting to lower non-cell related battery pack prices by 30-40% by the end of next year.

One of the battery suppliers of Nikola for its prototype electric trucks, Romeo Power, along with LG Energy Solution and Proterra Inc, designs and produces lithium-ion battery modules and packs for commercial car applications. Nikola expects, as the biggest consumer of Romeo, that the investment will enable “significant operational improvement and cost reduction in battery pack production.”

The addition of the battery of Romeo and battery management system (BMS) engineering capacities are also expected to help increase product development and enhance performance for consumers of Nikola. The Power depots of Romeo in Cypress, California, will become the Battery Center of Excellence of Nikola, following the completion of the agreement.

“Romeo has been a valued supplier to Nikola, and we are excited to further leverage their technological capabilities as the landscape for vehicle electrification grows more sophisticated. With control over the essential battery pack technologies and manufacturing process, we believe we will be able to accelerate the development of our electrification platform and better serve our customers.”

–Mark Russell, Nikola’s Chief Executive Officer

Nikola will buy all the remaining stocks of the common share of Romeo Power, which is under the terms of the contract. Romeo investors will receive 0.1186 of a stock of Nikola common share for each Romeo stock, representing an equity value of around $144 million and 4.5% as a matter of the form of Nikola’s possession.

A newly formed subsidiary of Nikola will be integrated into Romeo after the successful completion of the exchange offer. The agreement is expected to be completed by the end of October of this year.

Nikola will provide it with $35 million in temporary funding to support Romeo function through closing with additional liquidity assistance to be accessible in the time the transaction closing is set back.