This past month, while in Las Vegas for CES 2023, that pestering déjà vu feeling kept appearing. A company was pitching lidar sensor technology at every corner in the newly constructed West Hall of the Las Vegas Convention Center and even among the crowded startup grinder at Eureka Park.

In 2017 or 2018, that wouldn’t have been as remarkable. However, 2023 has arrived.

The hype cycle’s peak, when millions of dollars were invested in lidar startups, is now a dim memory. The industry underwent a phase of the business model pivot and followed the wave of notable purpose acquisition mergers to obtain capital from public markets.

Dozen of Lidar companies sold by rivals

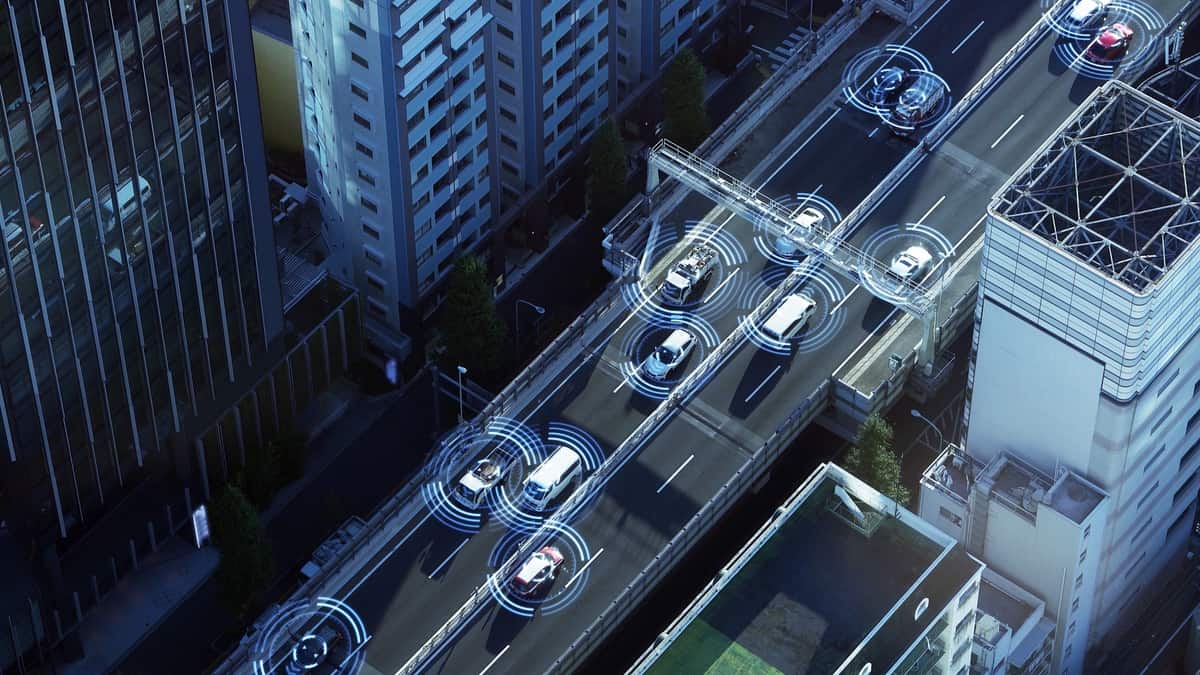

LiDAR, a type of radar that uses laser light to measure distance and creates a high-accuracy 3D map of the world, is thought to be a crucial sensor for autonomous vehicles and increasingly sophisticated driver assistance systems.

Industry estimates suggest that in 2018, there were 65 to 70 active lidar programs. Consolidation appeared inescapable as the schedules for the rollout of autonomous vehicles slipped. It was, too. In the last four years, dozens of lidar companies have gone out of business or purchased by rival firms.

2019 saw the start of consolidation. Since then, it has only accelerated. Because of the cost of development and the possibility of inflated valuations, because they were based on projected rather than actual revenue, the seek-capital-in-public-markets strategy launched in 2020 has yet to be as successful as some had hoped.

One bankruptcy and a merger among the nine businesses went public through SPAC mergers, including Aeye, Aeva, Cepton, Luminar, Innoviz, Ouster, and Velodyne. About ten months after going public via a merger with a SPAC, Quanergy filed for bankruptcy protection in December 2022. In November 2022, Ouster, a SPAC that had acquired Sense Photonics in 2021, agreed to merge with Velodyne in an all-stock deal.

Lidar isn’t booming enough

According to the lidar company Luminar, it can confirm 25 businesses with active lidar programs, which is connected with other estimates in the sector.

If one were to walk the CES 2023 exhibit floor, one might believe that business is booming enough to support twenty-two companies. It isn’t.

According to Taylor Ogan, CEO of Snow Bull Capital, many lidar companies will be eliminated this year, with 2024 serving as the “make it or break it year” for those that survive.

I think we will see the big OEMs make lidar commitments in 2023,” Ogan said, adding that a lot of models will be unveiled with lidar. But 2024 will be the make-or-break year for lidar companies, where we will see whose fancy booths at CES were just that and who is actually going to deliver

Taylor Ogan, CEO of Snow Bull Capital stated on Lidar companies

80% of Asia installed Lidar automobile sensors

According to Ogan, Asia is home to about 80% of the lidar companies installing automobile sensors.

Hesai, RoboSense, and Livox, three Chinese companies, won design awards from automakers and shipped sensors for production models in 2022. The top producer of lidar sensors is Hesai. According to a recent securities filing, the company will have shipped more than 103,000 lidar units between 2017 and December 31, 2022.

The majority of that production, though, took place in 2022, when it produced and dispatched more than 80,000 sensors. Of those, 62,000 Hesai vehicles have been sold to Chinese automakers such as Li Auto, Jidu, and Lotus to support advanced driver assistance systems.

The remaining will use in other applications, including smart infrastructure, mining, agriculture, robotaxis, and mapping. This year, Hesai’s production expected volume would increase. This year, the business will open a third factory in Shanghai with a production capacity of 1 million units annually.

‘make it or break it’ for Lidar

A small number of American businesses also manufacture and market lidar sensors for use in industrial and robotic applications. And that list gets even shorter when it comes to American lidar companies that ship sensors to finished vehicles.

Luminar, a company turned publicly traded company with operations in Florida and Silicon Valley, is one of the most talked-about businesses. To support ADAS in SAIC Motor’s new electric SUV, the Rising Auto R7, Luminar has begun manufacturing and shipping its Iris lidar sensors to the Chinese automaker. Additionally, the forthcoming Polestar 3 SUV and Volvo‘s new electric EX90 SUV will use its sensors.

To provide Mobileye with lidar for its fleet of robotaxis, Luminar and the company entered into a contract in 2020. Nissan and Mercedes have also signed agreements with it.

Founder and CEO Austin Russell restated onstage at CES 2023 that the company anticipates more than 1 million Luminar-equipped vehicles will be on the road by the second half of the decade (so after 2025) based on internal estimates.

Additionally, Innovation, a Silicon Valley-based business with operations in Suzhou, China, provides sensors to Chinese automaker Nio. Despite the possibility of leadership changes, industry experts predict that the number of lidar companies will decrease.

According to Mike Ramsey, VP analyst at Gartner for automotive and smart mobility, the lidar market will “directionally” begin to resemble the millimeter wave radar market. Seven or eight businesses, including Aptiv, Bosch, Continental, and ZF, provide millimeter-wave radar to the automotive industry.

“I can’t see why lidar for auto would be different,” Ramsey stated. He did add that lidar has more uses besides automobiles, which might help a few other businesses.